Some oil and gas sector experts have voiced their concerns over the Nigerian National Petroleum Company Limited (NNPCL) dominance of fuel importation in the country.

Since May 29, 2023 when President Bola Tinubu during his inauguration declared that “fuel subsidy is gone,” the Nigerian National Petroleum Company Limited (NNPCL) directed its outlets nationwide to sell Premium Motor Spirit (PMS) between N480 and N570 per litre, an almost 200 per cent increase from the initial price below N200, leading to a significant increase in transportation fares and prices of goods and services.

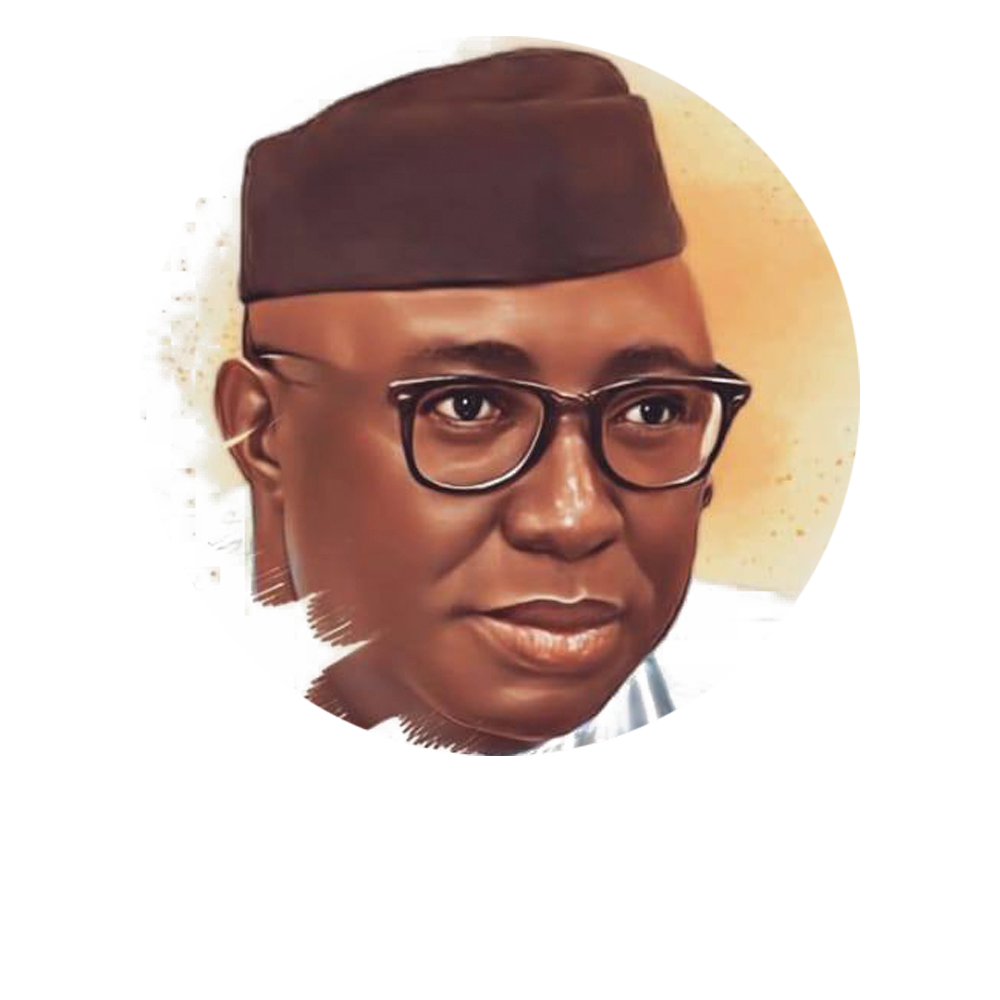

Again in July, petrol pump prices rose to about N617/N620 per litre at various outlets of the NNPCL in Abuja and many parts of the country. At the time, the NNPCL attributed the rise in prices to ‘market forces’. The NNPCL Group Chief Executive Officer, Mele Kyari, explained that with the deregulation of the oil sector, market realities will force the price of petrol up sometimes and at other times force it down.

Despite the immediate pains and uncertainties brought about by the president’s abrupt subsidy removal announcement, Nigerians in their patriotic spirits kept hope with the new government especially with repeated assurances from them that funds for the subsidy will be diverted to other pressing demands like public infrastructure, education, health care and jobs. The downstream oil industry players saddled with the onerous responsibilities of refining, marketing, distributing and selling the products to everyday users also keyed into the government’s directives since removal of the subsidy was also expected to allow for more private-sector operators in the petrol sector including in the importation of the product.

Recall that NNPCL has since 2016 been the sole importer of PMS in Nigeria. But on 15 June, the company announced it was no longer the sole supplier of petroleum products in the country.

The development came months after the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) said it was fast-tracking the process of issuing oil marketers licenses to import petroleum products in its bid to break the monopoly of the NNPCL in compliance with the Petroleum Industry Act (PIA) 2021.

Owing to this development, several indigenous oil companies applied for oil importation licenses and over 94 of them were licensed.

Findings revealed that seven months after acquiring the licenses, only few of the oil marketers have been able to do business with it. According to them, challenges such as forex scarcity, fluctuation in prices of crude oil, poor distribution networks and others which were duly addressed in PIA still persist. However, they submitted that most pressing of these challenges is forex.

“People keep asking why most licensed oil marketers are no longer in business as if they don’t know the answer. How do I run a business that is obvious will be on loss? Where do I get forex to import this product? The NNPCL being a government funded company is the only one still doing business because it can access forex in whatever amount it so desire and that is the aim of collapsing the multi-forex windows to just Investors and Exporters (I&E) window as far as I am concerned. It’s majorly to run the Independent and Major oil marketers out of business,” an enraged marketer said.

Over the past four months, the naira has depreciated by over 50 per cent at both the authorised and unauthorised market segments, after the Central Bank of Nigeria (CBN) announced in June that it had collapsed all forex windows into the Investors and Exporters (I&E) window. The move, according to the apex bank, was part of the federal government’s efforts to improve liquidity and stability in the market and attract foreign investors into the Nigerian economy.

Consequently, the policy has put additional pressure on the local currency and manufacturers, with ripple effects on domestic prices. Oil marketers that had allocations to import and supply petroleum products are unable to do so due to forex scarcity. Some fuel marketers said they are hardly able to access dollars and open letters of credit for their imports.

Speaking at the National Executive Council meeting of the Natural Oil and Gas Suppliers Association of Nigeria (NOGASA) in October, National President of the Association, Benneth Korie, said many petroleum products depots are currently deserted due to a lack of products caused by foreign exchange rate volatility.

“Depot owners are so terribly affected by the increasing cost of crude oil and exchange rate, to the extent that many depots are practically deserted as their owners are unable to secure bank loans to fund their business due to high-interest rates.

“Banks are not willing to guarantee funds release to stakeholders as a result of the difficulty, instability and galloping rates of foreign exchange and high cost of the dollar. Many depots are presently dried up or out of stock, and this is no gainsaying as it is evidently verifiable.

“Worst hit are filling stations whose owners find it extremely difficult to secure funds to procure products for their retail outlets. Both the independent and major marketers are so terribly affected,” Korie said at the time.

Meanwhile, NNPCL recently confirmed it has returned to being the sole importer of petrol in the country.

The NNPCL boss who disclosed this during the Energy Labour Summit organised by the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) in Abuja said licensed private oil companies are unable to obtain foreign exchange for importation.

“We are the only company importing premium motor spirit (PMS) into the country.

“None of them (oil companies) can do it today. For them, access to foreign exchange is difficult. We create foreign exchange (FX), therefore we have access to FX, while their access to FX is limited,” Kyari said.

In what appeared like a reinforcement of his earlier statement, the NNPCL GCEO during his recent appearance before the Senate Committee on Appropriation proudly blamed the withdrawal of oil companies from fuel importation on implementation of PIA.

He said, “The oil companies withdrew because they can’t manage the oscillation and responsibility that the Petroleum Industry Act imposed on us. We have the market and I can assure you that we are managing this.

“Some marketers buy from us and sell. But there is an element that we can’t control. For instance, truck owners can adjust their prices, we have no control over that.”

Kyari further claimed that the distortion in the foreign exchange market which the marketers argued was a disincentive to their participation in the fuel importation business was nothing to worry about.

He said, “There is always a parallel market in every country. There is also an import and export window in every country, even in the developed world. But there is always a narrow gap between the two and it takes time for you to have stability in this gap so that you have a low margin between the two for a sustained period, then businesses will thrive.”

He added, “I am very confident that by the end of the first quarter of next year, those margins will narrow and stability will come and you will see others coming into the importation market.”

However, industry experts are of the opinion that if not properly managed the forex crisis and other challenges facing the downstream industry players will cripple the economy, kill businesses and plunge the country into a deeper mess than it is already in.

“Why license these guys to import fuel if the intention is to render them idle? With the way the NNPCL GMD is gloating over his accessibility to forex and market dominance, you can almost infer that the challenges were artificially created for the NNPCL to lord over the private oil companies. The devastating reality of all this is Nigerians will be at the receiving end. Companies will fold up, jobs will be lost and the country will run into a deeper mess. How many Nigerians can NNPCL serve? The President has a major role to play since he has decided to go the way of his predecessors by approbating the Petroleum Ministry to himself. He should act fast before it is too late,” an industry expert and analyst said.

Industry experts further appealed to President Tinubu to the needful and allow for full implementation of PIA to build a robust, competitive and productive sector.

Ms Anozie is a Senior Energy Correspondent with Energy & Business Media Ltd