By Silverline Anozie, Senior Energy Correspondent

Indications have emerged that Nigerians may start experiencing fresh hike in pump prices of petroleum products after the Federal Government failed to renew its naira-for-crude agreement between the Nigerian National Petroleum Company Limited (NNPC Limited) and Dangote Refinery.

The six-month deal, which started in October 2024, will officially end on Monday, March 31, 2025. The deal’s extension or suspension has not been decided by parties involved days to its expiration. However, sources close to the presidency predicted that the parties may likely meet in the coming weeks.

Recall that Nigeria officially commenced the sale of crude oil and refined petroleum products in naira on October 1, 2024, after the Federal Executive Council (FEC) approved a proposal by President Bola Tinubu directing the NNPC to sell crude oil to Dangote Refinery and other refineries in the local currency.

However, in November last year, the Dangote Refinery raised the alarm that the crude-for-naira initiative was faltering, as it was still unable to secure adequate supplies.

Already, Nigerians are beginning to feel the impact of the deal fallout as pump prices of the petroleum products are beginning to rise. According to reports and experts’ opinions, the full consequential effects of the deal fallout will fully manifest from next week (after Eid break) with the product likely hitting N1,000/Litre.

In what appears like a strong warning signal to the Federal Government, the Dangote Petroleum Refinery on Wednesday, March 19, in a statement said it has temporarily halted the sale of petroleum products in naira.

In the statement, the refinery said the decision to halt sales in naira was “necessary to avoid a mismatch between our sales proceeds and our crude oil purchase obligations, which are currently denominated in U.S. dollars”.

“To date, our sales of petroleum products in Naira have exceeded the value of Naira-denominated crude we have received. As a result, we must temporarily adjust our sales currency to align with our crude procurement currency,” the statement partly reads.

The firm, however, assured that sales would resume in naira as soon as they receive crude supply in naira from the Nigerian National Petroleum Company (NNPC) Limited.

“As soon as we receive an allocation of Naira-denominated crude cargoes from NNPC, we will promptly resume petroleum product sales in Naira.”

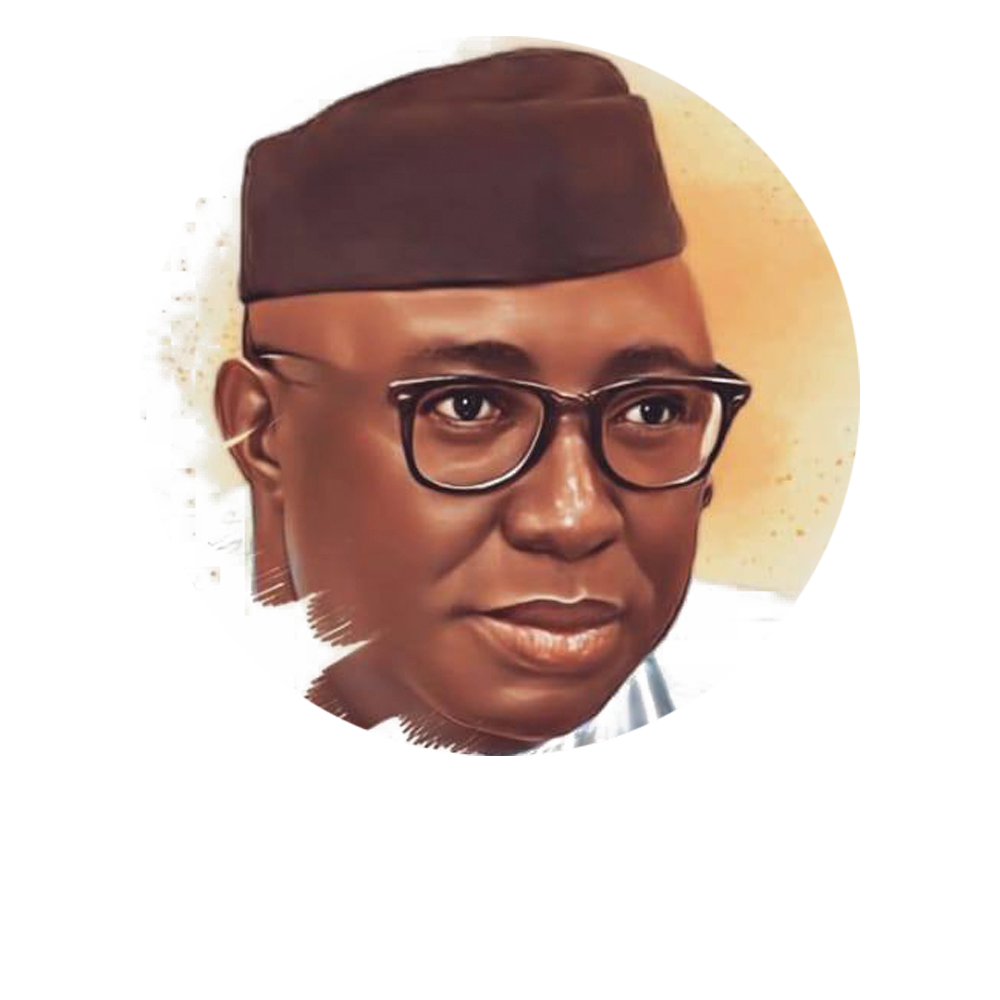

Recall that the Chairman of the naira-for-crude policy technical sub-committee, Zaach Adedeji, had earlier reassured that the naira-based crude oil supply arrangement with local refineries has not been discontinued.

“The policy framework enabling the sale of crude oil in naira for domestic refining remains in force. The initiative was designed to ensure supply stability and optimise the utilisation of local refining capacity.

“There has been no decision at the policy level to discontinue this approach nor is it being considered. After implementing the policy for some months, evidence abounds that it is the right way to go, and it will continue to help the economy.

“The engagement process for crude oil supply to domestic refineries therefore remains in place by structured agreements, balancing factors such as availability, demand, and market conditions.

“There is no exclusion of local refineries from access to domestic crude. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) is actively ensuring compliance with the Domestic Crude Oil Obligations provisions of the Petroleum Industry Act,” he said.

Ms Anozie is a Senior Energy Correspondent with Energy & Business Media